|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Auto Coverage: Comprehensive Guide for U.S. ConsumersWhen it comes to protecting your vehicle, understanding auto coverage is essential for peace of mind and cost savings. In the U.S., auto coverage encompasses various types of protection, from basic liability to comprehensive plans and extended warranties. This guide will help you navigate the options, understand what’s covered, and make informed decisions. Understanding Auto Coverage OptionsAuto coverage generally includes a few key categories:

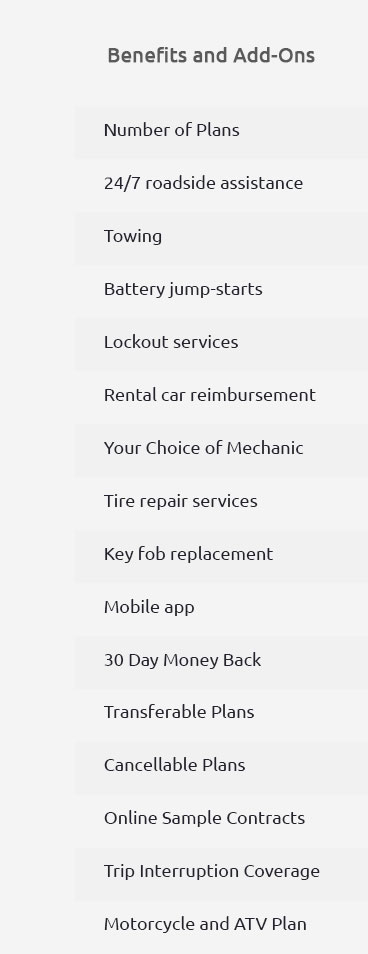

Exploring Extended Auto WarrantiesExtended auto warranties offer additional protection beyond the manufacturer's warranty. They can cover repairs and replacements for key components like the engine and transmission, providing substantial cost savings over time. For example, if you own a Honda, exploring honda extended warranty plans could extend your vehicle's protection and minimize unexpected expenses. Benefits of Comprehensive Auto CoverageInvesting in comprehensive auto coverage offers numerous benefits:

Local Considerations in the U.S.In areas like California and New York, insurance requirements and costs can vary significantly. Understanding local regulations and average repair costs can help you choose the right level of coverage. Additionally, for those in regions with higher theft rates, such as certain urban areas, comprehensive coverage may be more beneficial. Frequently Asked QuestionsWhat is Symbol 2 Auto Coverage?Symbol 2 auto coverage typically refers to a specific classification used by insurance companies to determine rates and coverage options. For more details on this classification, visit symbol 2 auto coverage. How can I save on auto coverage in the U.S.?To save on auto coverage, consider bundling insurance policies, maintaining a clean driving record, and exploring discounts for safety features or low mileage. Is an extended auto warranty worth it?An extended auto warranty can be a worthwhile investment if you plan to keep your car long-term and want to avoid unexpected repair costs. https://www.tdi.texas.gov/pubs/consumer/cb020.html

It also pays the other driver's and his or her passenger's medical bills and some other expenses. Texas law requires you to have at least $30,000 of coverage ... https://www.tdi.texas.gov/consumer/auto-insurance.html

Questions? Call us at 800-252-3439. X - Facebook - LinkedIn - podcasts ... https://www.allstate.com/auto-insurance

Get a quick, personalized car insurance quote today. A great rate on auto insurance is just a few clicks away. Start your free quote online.

|